尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

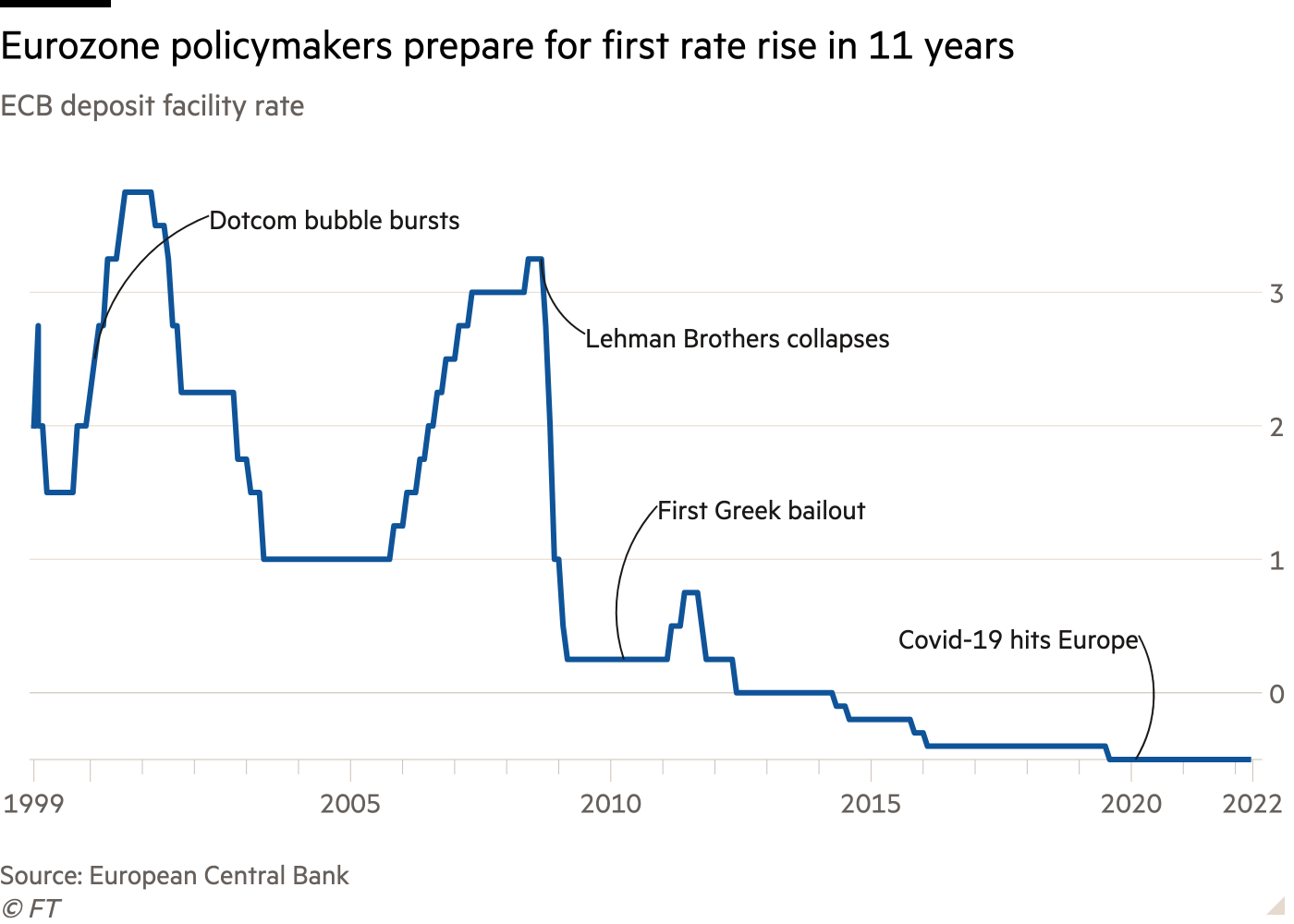

The last time the European Central Bank raised interest rates in 2011 it was forced to reverse the move within months as the eurozone was plunged into a wrenching debt crisis. The market panic that followed only subsided after Mario Draghi, then head of the ECB, declared it would do “whatever it takes” to save the euro.

欧洲央行上一次加息是在2011年,该行被迫在几个月内改变了做法,因为当时欧元区陷入了严重的债务危机。在时任欧洲央行行长马里奥•德拉吉(Mario Draghi)宣布将“不惜一切代价”拯救欧元之后,随之而来的市场恐慌才有所平息。

Fears of a similar outcome are front of mind for many as current president Christine Lagarde prepares the ECB’s first rate rise in 11 years. The move, to be announced on Thursday, will come alongside a new bond-buying plan that the central bank hopes will prevent rising borrowing costs from sparking another eurozone debt meltdown.

在现任欧洲央行行长克里斯蒂娜•拉加德(Christine Lagarde)准备进行欧洲央行11年来的首次加息之际,对类似结果的担忧已萦绕在许多人的心头。在周四宣布这一举措的同时,欧洲央行还将推出一项新的债券购买计划,希望该计划能防止借贷成本上升引发另一场欧元区债务危机。

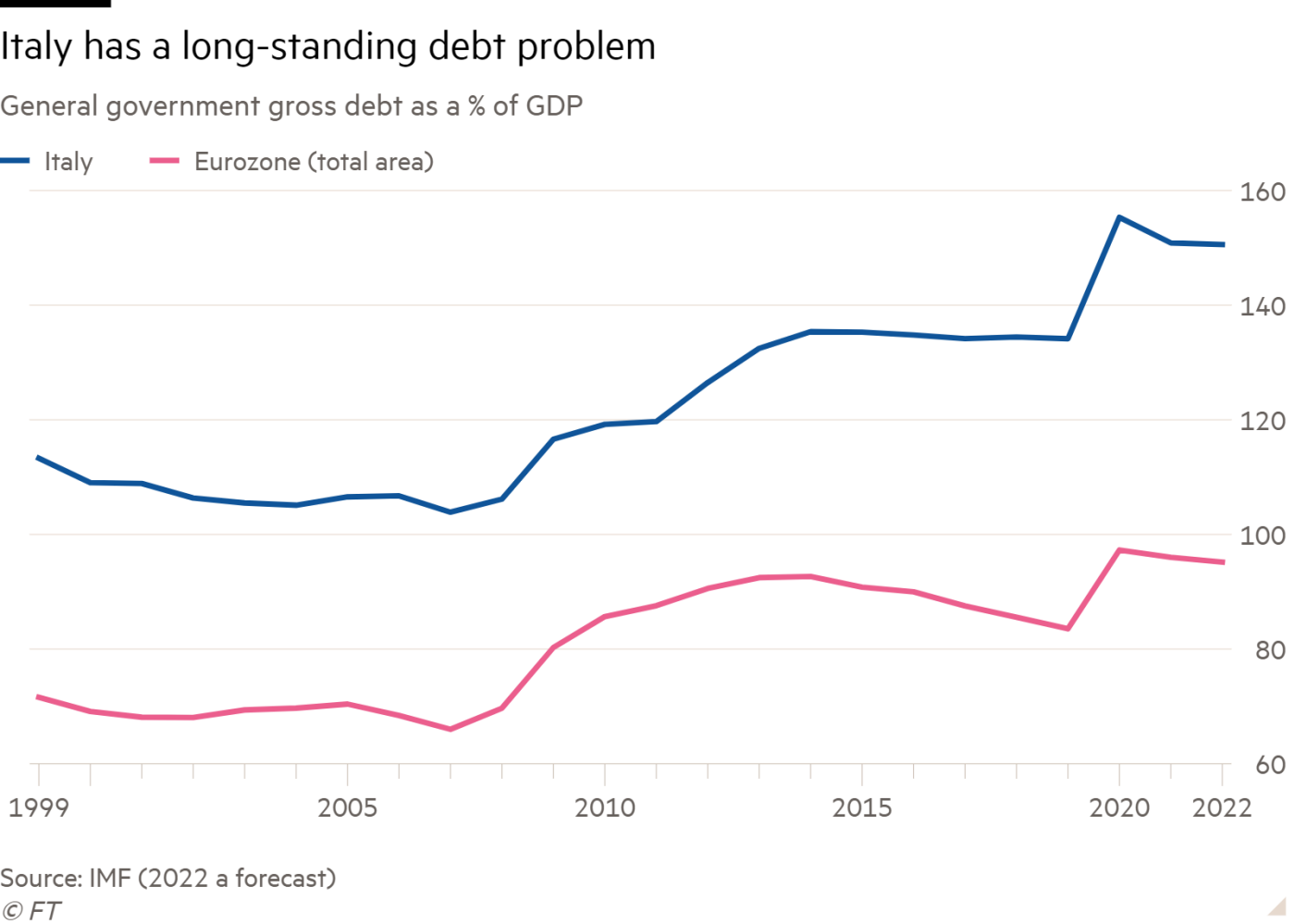

Draghi, who left the ECB in 2019 and became the Italian prime minister last year, seems bound to play a pivotal role once more as he prepares to address parliament in Rome on Wednesday, only days after his ruling coalition splintered. This has fuelled speculation about an early Italian election this year, which could shake investors’ confidence in the country’s ability to manage its swollen public debt that now stands at more than 150 per cent of gross domestic product.

德拉吉于2019年离开欧洲央行,去年出任意大利总理。在他准备于周三在罗马向议会发表讲话之际,他似乎注定要再次发挥关键作用。就在几天前,他领导的执政联盟出现分裂。这引发了有关意大利今年将提前举行大选的猜测,这可能动摇投资者对该国管理庞大公共债务能力的信心。目前意大利公共债务与国内生产总值(GDP)之比已超过150%。

As well as political upheaval in Italy, economists also worry about a growing energy crisis in Germany, where officials are nervously waiting to find out if Russia will turn the gas back on this Thursday after a scheduled 10-day maintenance period for one of its main pipelines to Europe. If the gas does not flow or if there are further delays in winter, several EU countries that rely on it are set to impose energy rationing, starting with heavy industrial users, which is likely to trigger a severe economic downturn across the bloc.

除了意大利的政治动荡之外,经济学家还担心德国日益加剧的能源危机。德国官员正紧张地等待着,看俄罗斯是否会在本周四重启输往欧洲的一条主要管道。此前,按照计划,俄罗斯的一条输往欧洲的天然气管道进行了为期10天的维护。如果天然气无法输送,或者在冬季进一步推迟供应,几个依赖天然气的欧盟国家将从重工业用户开始实行能源配给,这可能会引发整个欧盟的严重经济衰退。

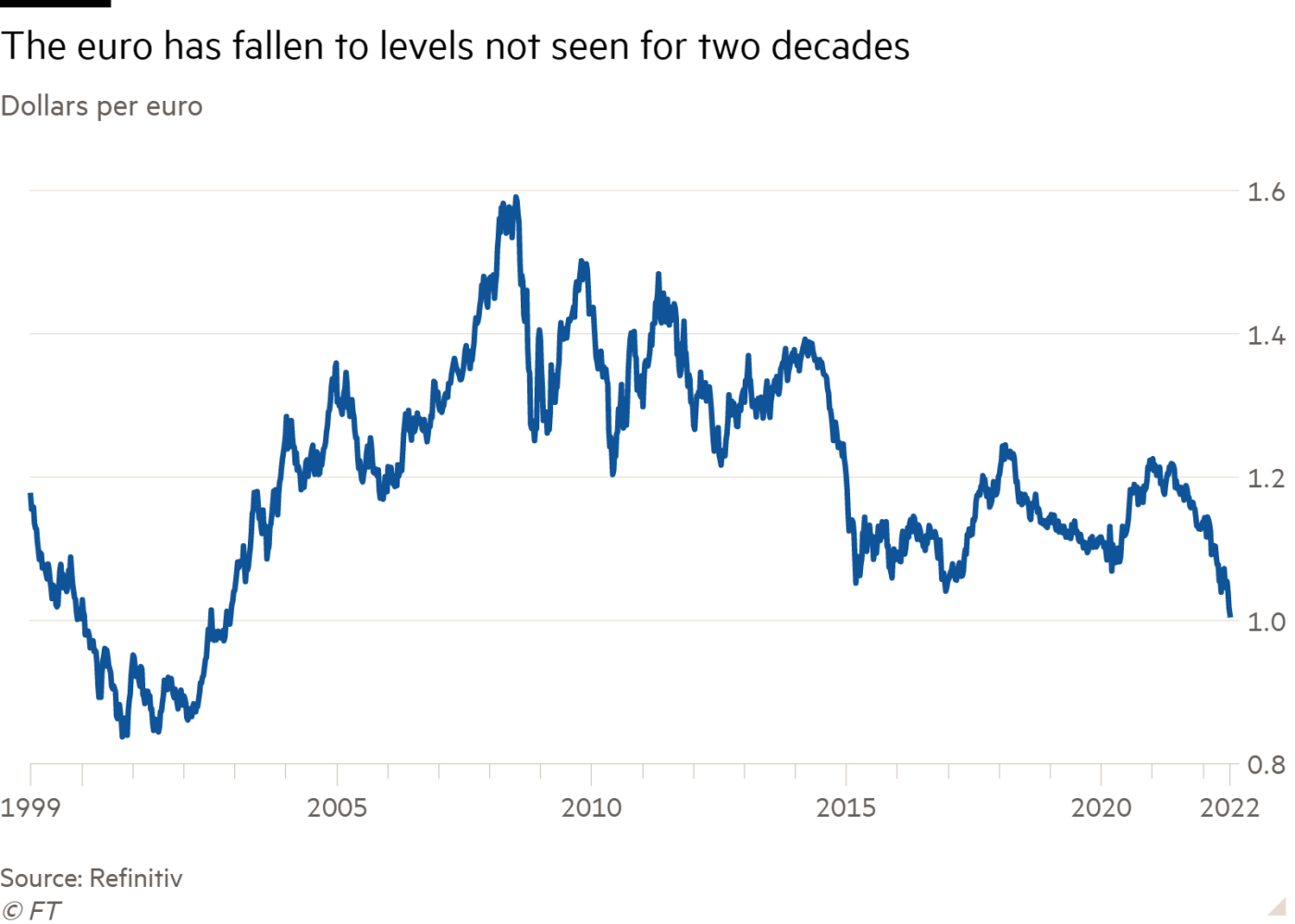

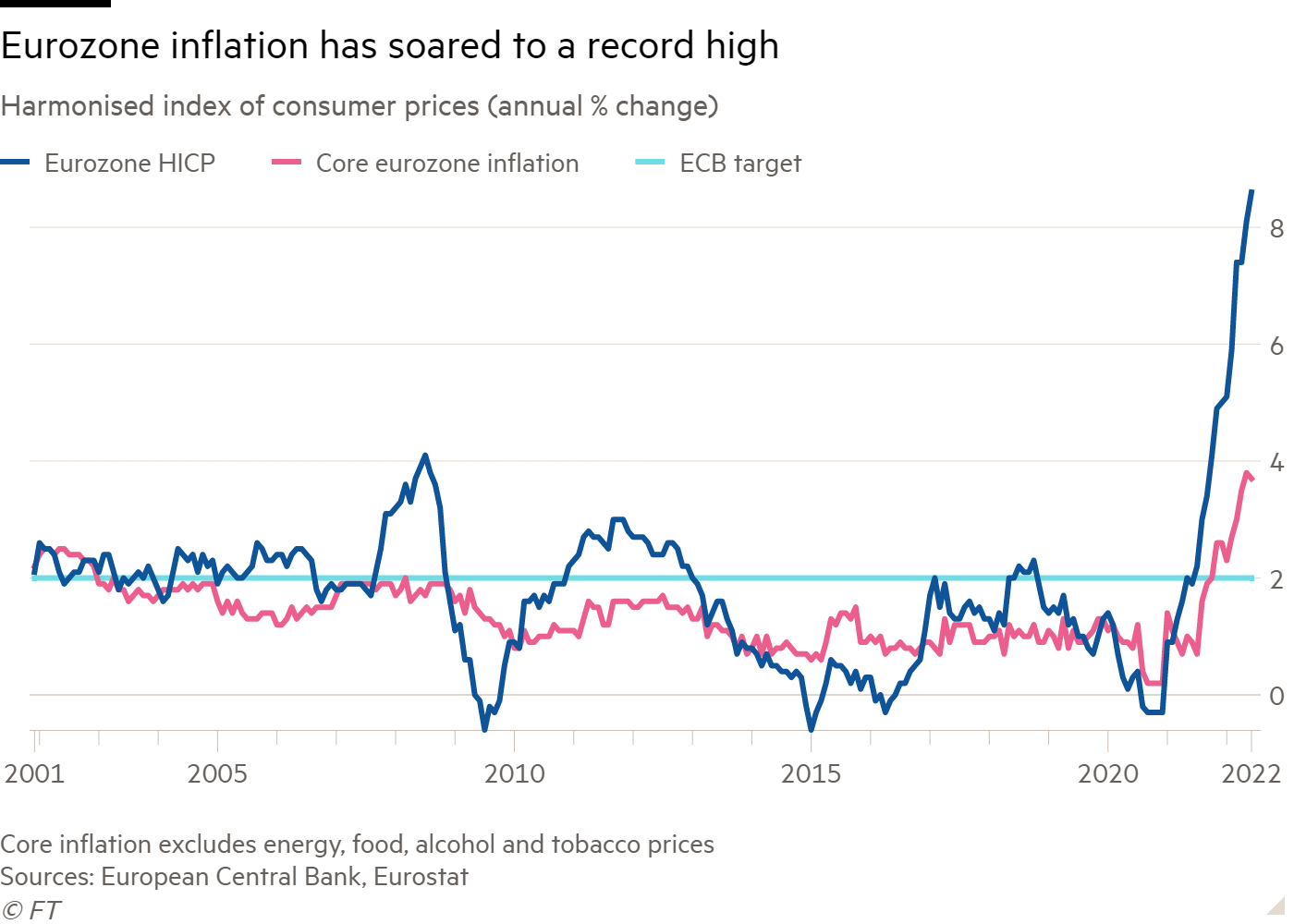

The worsening outlook is reflected in last week’s sharp fall in the euro below the value of the US dollar for the first time in 20 years. Yet the ECB has little choice but to start raising rates after inflation in the bloc surged to a record high of 8.6 per cent in the year to June, more than quadruple its target.

上周,欧元兑美元汇率的大幅下跌就反映了这种日益恶化的前景,这是欧元对美元20年来首次跌破平价。然而,欧洲央行别无选择,只能开始加息,原因是,在截至今年6月的一年里,欧元区通胀率飙升至8.6%的创纪录高点,是其目标的四倍多。

“The risk ahead of us is that because of the energy crisis, the euro area could end up in recession, while at the same time the ECB will have to keep raising interest rates if inflation does not come down,” says Maria Demertzis, deputy head of the Brussels-based Bruegel think-tank. “It is an almost impossible situation.”

“摆在我们面前的风险是,由于能源危机,欧元区可能最终陷入衰退,而与此同时,如果通胀不降下来,欧洲央行将不得不继续加息,”位于布鲁塞尔的智库Bruegel的副总裁玛丽亚•德默茨(Maria Demertzis)表示。“这几乎是一个不可能解决的局面。”

‘Too slow and too late’

“太慢也太迟了”

The ECB is grappling with more complex challenges than most major central banks. The eurozone is bearing the brunt of the fallout from Russia’s invasion of Ukraine. The war is driving up energy and food prices and fuelling political instability, while the risk of a fresh eurozone debt crisis is never far away due to the incomplete nature of its monetary union with different countries having separate budgets and bond markets.

与大多数主要央行相比,欧洲央行正在应对更为复杂的挑战。欧元区正承受着俄罗斯入侵乌克兰的冲击。这场战争推高了能源和食品价格,加剧了政治不稳定,而由于欧元区货币联盟并不完整——不同国家拥有不同的预算和单独的债券市场——欧元区爆发新的债务危机的风险从未远离。

In these volatile circumstances, Lagarde has said the central bank intends to normalise policy “gradually” starting with a quarter point rise in its deposit rate to minus 0.25 per cent on Thursday ahead of a bigger rise above zero in September if price growth remains high.

在这种动荡的环境下,拉加德表示,欧洲央行打算“逐步”实现政策正常化,首先在周四将存款利率上调25个基点,至-0.25%,如果物价增长仍处于高位,9月份将更大幅度上调至高于零的水平。

The ECB has acted more cautiously than the Federal Reserve, which has already raised US rates three times and is next week expected to raise them again by at least three-quarters of a percentage point. The IMF said that over the past year 75 of the 100 central banks it tracks have raised rates on average almost four times each, by 3 percentage points in emerging markets and 1.7 points in advanced economies.

欧洲央行的行动比美联储更为谨慎。美联储已三次上调美国的利率,预计将在下周再次加息至少0.75个百分点。国际货币基金组织(IMF)表示,过去一年,在其追踪的100家央行中,有75家央行平均每家加息近4次,其中新兴市场加息3个百分点,发达经济体加息1.7个百分点。

Many believe the ECB is being too timid to curb inflation, which hit double-digit figures in nine out of the 19 eurozone countries in June. “The very gradual and cautious normalisation process the ECB started at the end of last year has simply been too slow and too late,” says Carsten Brzeski, head of macro research at Dutch bank ING.

许多人认为,欧洲央行在抑制通胀方面过于胆怯。今年6月,欧元区19个国家中有9个的通胀率达到了两位数。荷兰国际集团(ING)宏观研究主管卡斯滕•布尔泽斯基(Carsten Brzeski)表示:“欧洲央行去年年底启动的非常渐进和谨慎的正常化进程,实在太慢也太迟了。”

Some members of the ECB’s rate-setting governing council — notably those in Baltic countries where inflation is close to 20 per cent — have broken ranks to call for a more aggressive half-point rate rise on Thursday.

欧洲央行负责制定利率的管理委员会的一些成员——尤其是那些通胀率接近20%的波罗的海国家的成员——周四打破传统,呼吁更激进地加息50个基点。

“It is like antibiotics, it doesn’t help if you take them in September if you are ill now,” says one of the more hawkish ECB council members. “Interest rates are our medicine and the timing and size of the dosage are of utmost importance.”

“这就像抗生素,如果你现在生病了,在9月份服用是没有用的,”一位较为鹰派的欧洲央行理事会成员表示。“利率是我们的良药,用药的时机和剂量至关重要。”

Up to now, the eurozone economy has been relatively resilient, with retail sales and industrial production remaining above last year’s levels, while the lifting of Covid-19 restrictions has boosted summer travel and tourism.

截至目前,欧元区经济相对有韧性,零售和工业生产仍高于去年水平,而新冠肺炎限制的解除促进了夏季旅游和旅游业。

But economists expect high prices to erode the spending power of European households and weigh on industrial output as companies reduce production.

但经济学家预计,高物价将削弱欧洲家庭的购买力,并在企业减产之际打压工业产出。

“If you are a company and gas is an essential input for production, you are probably going to [have started to] produce less already in anticipation of possible supply disruptions,” says Spyros Andreopoulos, senior European economist at French bank BNP Paribas. “We are already seeing signs of this starting to happen.”

法国巴黎银行(BNP Paribas)高级欧洲经济学家Spyros Andreopoulos表示:“如果你是一家公司,而天然气是生产的重要投入,你很可能(已经开始)减少产量,因为你预计供应可能会中断。我们已经看到这种情况开始发生的迹象。”

Economists at Germany’s Deutsche Bank estimate the skyrocketing price of imported energy and food will deliver a €400bn negative hit to the eurozone’s balance of trade this year. This is already draining confidence among consumers and businesses, which points to a likely downturn later this year, especially as the US and Chinese economies are already slowing sharply.

德国德意志银行(Deutsche Bank)经济学家估计,进口能源和食品价格飙升,将给欧元区今年的贸易平衡带来4000亿欧元的负面影响。这已经削弱了消费者和企业的信心,预示着今年晚些时候可能会出现低迷,尤其是在美国和中国经济已经大幅放缓的情况下。

But the single biggest thing keeping senior ECB officials awake at night is the fear that Russia is weaponising its energy exports to press for an advantage in its invasion of Ukraine by increasing the economic pain for Europe.

但让欧洲央行高级官员夜不能寐的最大的一件事是,他们担心俄罗斯正在将其能源出口武器化,通过加大欧洲遭遇的经济阵痛,来争取在入侵乌克兰的行动中占据优势。

“The dependency of European countries — and the euro area is a case in point — on external supplies from foes, has had a major impact on prices,” Lagarde said in June. “That could contribute to inflation directly — if it leads to further rises in energy costs — or indirectly, if a higher level of energy prices makes some production uneconomic and leads to a durable loss of economic capacity.”

拉加德今年6月表示:“欧洲国家——欧元区就是一个典型的例子——对来自对手的外部供应的依赖,对价格产生了重大影响。”如果能源价格进一步上涨,这将直接导致通货膨胀;而如果能源价格上涨使一些生产变得不经济,并导致经济产能的持久损失,这将间接导致通货膨胀。”

Sven Jari Stehn, chief European economist at US investment bank Goldman Sachs, says eurozone inflation is likely to peak above 10 per cent in September. But if Russian gas flows stopped completely, he warns “the risks are skewed towards a sharp contraction and even higher inflation”, adding the eurozone economy would keep shrinking until the second quarter of next year in these circumstances.

美国投行高盛(Goldman Sachs)首席欧洲经济学家斯文•贾里•斯特恩(Sven Jari Stehn)表示,欧元区通胀率可能会在9月份达到10%以上的峰值。但他警告称,如果俄罗斯的天然气供应完全停止,“可能会出现急剧收缩和更高的通胀”。他补充称,在这种情况下,欧元区经济将持续收缩,直到明年第二季度。

“It is a nightmare scenario for economic policymakers,” says Lars Feld, an economics professor at the Albert Ludwigs University of Freiburg, who advises the German finance minister. “It is more difficult than in the 2012 debt crisis, when we had a clear choice between monetary policy or fiscal policy solutions, but now both are much less clear.”

“对经济政策制定者来说,这是一场噩梦,”弗莱堡阿尔伯特•路德威格斯大学(Albert ludwig University of Freiburg)经济学教授拉尔斯•费尔德(Lars Feld)说。他是德国财政部长的顾问。“现在比2012年债务危机时更困难,当时我们可以在货币政策或财政政策解决方案之间做出明确选择,但现在两者都不那么明确了。”

Living with the ghosts of the debt crisis

与债务危机的幽灵共存

As long as inflation continues to rise, the ECB is expected to keep raising rates even if the economy starts to nosedive, while higher borrowing costs will make it harder for governments to spend more on shielding their citizens from the soaring cost of living. This is fuelling political tensions across Europe.

只要通货膨胀继续上升,欧洲央行预计将继续加息,即使经济开始暴跌,而更高的借贷成本将使政府更难花更多的钱来保护其公民免受飙升的生活成本的影响。这加剧了欧洲各地的政治紧张局势。

Public anger over surging energy and food prices played a key role in the fracturing of Draghi’s ruling coalition in Italy, which resulted in him offering his resignation — only to have it turned down by the president. High inflation also eroded support for French president Emmanuel Macron and contributed to his failure to win a parliamentary majority in elections in June.

公众对能源和食品价格飙升的愤怒在德拉吉领导的意大利执政联盟破裂中发挥了关键作用,导致他提出辞职,但却被总统拒绝。高通胀也削弱了法国总统埃马纽埃尔•马克龙(Emmanuel Macron)的支持率,导致他未能在6月份的选举中赢得议会多数席位。

“I fear political instability in Europe, in Italy and, of course, in France,” says Vítor Constâncio, former vice-president of the ECB who is now economics professor at the University of Navarra in Madrid. “If Macron has problems approving the budget next year there could be elections in France and the prospect of an Italian election is also a complicating factor, no doubt.”

欧洲央行前副行长、现任马德里纳瓦拉大学(University of Navarra)经济学教授的Vítor Constâncio表示:“我担心欧洲、意大利、当然还有法国的政治不稳定。如果马克龙在批准明年的预算方面有问题,法国可能会举行选举,毫无疑问,意大利选举的前景也是一个使问题更复杂的因素。”

Borrowing costs are already rising faster for heavily indebted southern European countries, such as Italy, than for some of their more fiscally solid northern counterparts, recalling the demons of the sovereign debt crisis that nearly ripped the eurozone apart a decade ago.

意大利等债台高筑的南欧国家,其借贷成本的上升速度已经快于一些财政状况更为稳固的北欧国家,这让人想起了10年前几乎撕裂欧元区的主权债务危机的恶魔。

This is an uncomfortable reminder for the ECB that, unlike the Fed or the Bank of England, it sets monetary policy for 19 different countries, each with its own budget and — crucially — bond market. That leaves the single currency vulnerable to a divergence in borrowing costs between countries which can test the sustainability of national debt levels.

这令人不安地提醒欧洲央行,与美联储或英国央行不同,欧洲央行为19个不同的国家制定货币政策,每个国家都有自己的预算,最关键的是,还有各自的债券市场。这使得欧元很容易受到各国借贷成本差异的影响,这可能会考验各国债务水平的可持续性。

“Of course you always have this general risk of a crisis in the periphery of the euro area playing out in the background,” says Dirk Schumacher, head of Europe macro research at French bank Natixis. “It is something the Fed doesn’t have to deal with.”

法国外贸银行(Natixis)欧洲宏观研究主管德克•舒马赫(Dirk Schumacher)表示:“当然,总有这种欧元区外围国家爆发危机的普遍风险在幕后上演。这是美联储不必处理的事情。”

In response, the ECB is expected to announce that it will tackle any unwarranted divergence in a country’s bond yields by buying its bonds using a new scheme it calls the transmission protection mechanism.

作为回应,预计欧洲央行将宣布,它将使用一种名为“传导保护机制”(transmission protection mechanism)的新机制购买一国债券,以解决该国债券收益率出现任何不必要的背离。

Unlike the yield curve control policy of Japan’s central bank, which is buying as many bonds as needed to cap the country’s borrowing costs at a fixed level, the ECB is unlikely to target a specific bond yield for each nation and will instead use its judgment on when to intervene.

日本央行采取收益率曲线控制政策,日本央行会购买尽可能多的债券,以将该国的借贷成本限制在一个固定水平。与之不同的是,欧洲央行不太可能针对每个国家制定特定的债券收益率目标,而是会根据自己的判断来决定何时干预。

That has sparked worries, particularly in more frugal countries such as Germany and the Netherlands, that the ECB will encourage fiscal profligacy among member states and stray into “monetary financing” of governments — the printing of money by a central bank to prop up a country’s budget — which is against the EU treaty.

这引发了人们的担忧,尤其是在德国和荷兰等更为节俭的国家,人们担心欧洲央行将鼓励成员国的财政挥霍,并错误地进行政府“货币融资”——由一家央行印制钞票以支撑一国预算——这违反了欧盟条约。

“Distinguishing what is political risk from market speculation empirically is impossible,” says Feld, the former chair of Germany’s council of economic experts. “The market pricing will have some disciplining effect on political decisions and we should let it work.”

德国经济专家委员会前主席费尔德表示:“从经验上讲,不可能区分什么是政治风险,什么是市场投机。市场定价将对政治决策产生一定的约束作用,我们应该让它发挥作用。”

Watching for market disruptions

留意市场动荡

The mounting anxiety in EU capitals over how best to respond to the punishing combination of rising prices and slumping growth is clear. While not forecasting a recession, the European Commission last week downgraded growth estimates and sharply increased predictions for inflation, which is now tipped to hit 7.6 per cent in the euro area this year and remain at twice the ECB’s 2 per cent target in 2023.

很明显,欧盟各国政府对于如何最好地应对物价上涨和经济增长下滑的双重打击越来越焦虑。尽管欧盟委员会(European Commission)预计不会出现衰退,但它上周下调了对经济增长的预期,并大幅上调了对通胀的预期。目前,欧元区的通胀预期有望达到7.6%,并将在2023年维持在两倍于欧洲央行2%目标的水平。

Draft commission proposals, due for release this week, would limit energy usage in public buildings, as it scrambles for ways of conserving gas given the threats from Moscow.

定于本周公布的欧盟委员会提案草案,将限制公共建筑的能源使用。考虑到来自莫斯科的威胁,该委员会正在努力寻找节约天然气的方法。

Officials are blunt about the economic headwinds facing Europe. Klaus Regling, head of the European Stability Mechanism bailout fund, last week warned that while the economy and consumers were under “massive strain”, markets are facing greater volatility given the combination of higher inflation and interest rates — something many traders have never experienced in their professional lives.

官员们对欧洲面临的经济逆风直言不讳。欧洲稳定机制(European Stability Mechanism)救助基金负责人克劳斯•雷格林(Klaus Regling)上周警告称,尽管经济和消费者承受着“巨大压力”,但鉴于通胀和利率的上升,市场正面临更大的波动——这是许多交易员在职业生涯中从未经历过的。

That does not mean we are facing a new “euro crisis”, insists Regling — a sentiment echoed by Paschal Donohoe, the eurogroup president, who has repeatedly stressed the stronger institutional set-up that the euro area enjoys today compared with a decade ago.

雷格林坚称,这并不意味着我们正面临一场新的“欧元危机”。欧元集团主席帕斯卡•多诺霍(Paschal Donohoe)也认同这一观点。多诺霍曾多次强调,与10年前相比,欧元区如今享有更强大的制度架构。

Nevertheless, the dangers of a sudden loss of market confidence are hanging heavily over officials’ planning — with Italy front and centre of their concerns.

然而,市场信心突然丧失的危险正严重笼罩着官员们的计划——意大利是他们最关心的问题。

The eurogroup last week discussed the creation of an informal task force of officials to monitor the markets during the summer break — a period in which low liquidity and thinly staffed trading floors can give rise to disruptive movements in bond yields and stock markets. The group will scan for emerging market hazards and have the power to convene policymakers if trouble erupts, according to people familiar with the plans.

欧元集团上周讨论成立一个由官员组成的非正式特别工作组,在暑假期间监控市场。在暑假期间,低流动性和人手不足的交易大厅可能会引发债券收益率和股市的破坏性波动。知情人士称,该组织将搜寻新兴市场的风险,并有权在问题爆发时召集政策制定者。

The search for closer co-ordination between institutions and member states speaks to a broader concern among finance ministries — namely the risk of disjointed or contradictory action by different member states that ends up eroding, rather than shoring up, market confidence.

各机构与成员国之间寻求更密切的合作,反映出各国财政部更广泛的担忧——即不同成员国采取不连贯或相互矛盾的行动的风险,最终可能削弱、而非支撑市场信心。

Emerging from a meeting in Brussels last Tuesday, Sigrid Kaag, the Dutch finance minister, stressed the need for unity among the currency union’s capitals, warning: “Everyone is struggling with the same issues, and if a recession is looming . . . I think we need to meet and converge around the same choices”.

荷兰财长西格丽德•卡格(Sigrid Kaag)上周二在布鲁塞尔出席会议后,强调了欧元区各国政府团结一致的必要性,并警告称:“每个国家都在努力解决同样的问题,如果衰退即将到来……我认为我们需要在相同的选择上达成一致。”

The 19 eurozone finance ministers say they have already agreed not to boost demand via extra borrowing next year, to ensure they don’t further stoke inflationary pressures.

欧元区19国财长表示,他们已经同意明年不再通过额外举债来提振需求,以确保不会进一步加剧通胀压力。

Holding a clear agreed line will, however, be much easier said than done. Italy is the main focus of member states’ concerns, given the risk that Rome will fall behind on its reform commitments or fail to keep a tight grip on public borrowing.

然而,保持一个明确的一致立场,说起来容易做起来难。意大利是成员国担忧的主要焦点,因为意大利有可能无法履行改革承诺,或未能严格控制公共借款。

Giuseppe Conte, the head of the Five Star Movement, last week withdrew its support from Draghi’s national unity government, throwing the ruling coalition into chaos. Conte accused the prime minister of doing too little to help families clobbered by soaring energy and food prices.

五星运动(Five Star Movement)领导人朱塞佩•孔特(Giuseppe Conte)上周撤回了对德拉吉领导的民族团结政府的支持,使执政联盟陷入混乱。孔特指责总理在帮助那些因能源和食品价格飙升而遭受打击的家庭方面做得太少。

If the government were to collapse it would raise doubts about Rome’s ability to pass a budget in November, fanning fears in northern capitals that Italy will once again emerge as a dangerous weak spot in the euro area’s armour.

如果政府解体,将使人们对罗马在11月通过预算的能力产生怀疑,这促使北欧国家担心意大利将再次成为欧元区盔甲中的一个危险的弱点。

Asked on Thursday about the situation in Rome, Paolo Gentiloni, the European economy commissioner, stressed the importance of not adding political tremors given the febrile global situation. “In these troubled waters — war, high inflation, energy risks, geopolitical tensions — stability is a value in itself. Now is the time for sticking together, for cohesion,” he said.

周四,当被问及罗马的局势时,欧盟经济专员保罗•真蒂洛尼(Paolo Gentiloni)强调了在全球局势紧张的情况下不增加政治动荡的重要性。他说:“在战争、高通胀、能源风险、地缘政治紧张等混乱局面中,稳定本身就是一种价值。现在是团结一致的时候了。”

After the Covid-19 pandemic hit in 2020, plunging much of Europe into a record postwar recession, Lagarde said there were “no limits” to the central bank’s commitment to the euro. That pledge may be about to be tested again.

2020年,新冠疫情爆发,欧洲大部分地区陷入战后创纪录的衰退,拉加德表示,欧洲央行对欧元的承诺“没有限制”。这一承诺可能将再次受到考验。