尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

Investors have been snapping up the debt of some of the eurozone’s most indebted countries to lock in attractive yields, as the traditional dividing lines between the bloc’s riskier and safer bond markets become increasingly blurred.

随着欧元区风险较高和较安全的债券市场之间的传统分界线变得越来越模糊,投资者一直在抢购欧元区一些负债最重国家的债务,以锁定有吸引力的收益率。

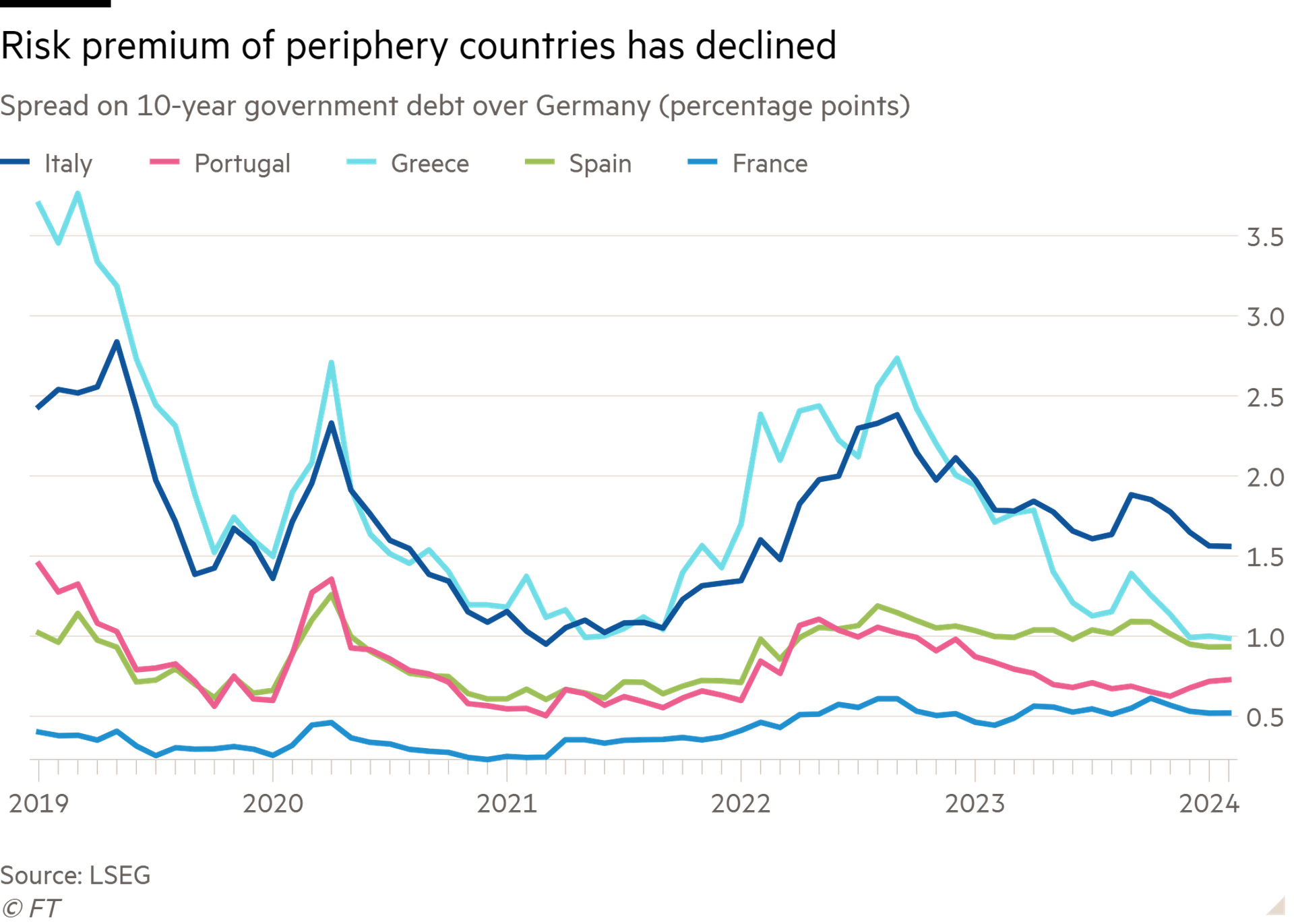

Traders have been encouraged by declining debt ratios in Italy, Portugal, Greece and Spain, say analysts. That has come on top of a broad rally in eurozone debt late last year on hopes of interest rate cuts, and helped narrow the gap between Italian and German borrowing costs — a key measure of eurozone risks — to 1.56 percentage points, near a two-year low. In October, the gap was more than 2 percentage points.

分析师们表示,意大利、葡萄牙、希腊和西班牙的债务比率不断下降,令交易员受到鼓舞。在此之前,由于市场对降息的希望,去年底欧元区债务普遍上涨,并帮助意大利和德国的借贷成本差距(衡量欧元区风险的一个关键指标)收窄至1.56个百分点,接近两年低点。10月份,这一差距超过了2个百分点。

The tightening of these spreads marks a major shift in sentiment across the euro area, just over a decade after a long-running debt crisis almost broke the single currency and led to bailout loans for a number of countries.

这些利差的收窄标志着整个欧元区的情绪发生了重大转变,而这距离一场旷日持久的债务危机仅过去了十多年。那场危机几乎摧毁了该单一货币,并导致一些国家获得救助贷款。

“We think 2024 will be the year when the boundaries blur between core and periphery,” said Aman Bansal, lead European rates strategist at Citi.

花旗(Citi)首席欧洲利率策略师阿曼•班萨尔(Aman Bansal)表示:“我们认为,2024年将是核心区和外围区之间界限模糊的一年。”

He pointed to falling debt to GDP levels among peripheral nations and higher net debt issuance in France and Germany.

他指出,欧元区外围国家的债务与GDP之比正在下降,法国和德国的净债务发行量也在上升。

Christian Kopf, head of fixed income at Union Investment, Germany’s third largest asset manager, said he had profited “handsomely” from buying the debt of Greece and Portugal, adding that their public debt ratios are falling.

德国第三大资产管理公司Union Investment的固定收益主管克里斯蒂安•科普夫(Christian Kopf)表示,他从购买希腊和葡萄牙债券中“获利丰厚”,并补充称,这两个国家的公共债务比率正在下降。

“It’s really quite simple,” he said. “Bonds that yield more than German Bunds are likely to also return more — unless the issuer’s solvency deteriorates significantly, which is not the case in the euro area periphery.”

“这真的很简单,”他说。“收益率高于德国国债的债券也可能获得更高的回报——除非发行人的偿付能力显著恶化,而欧元区外围国家的情况并非如此。”

According to IMF forecasts, debt to GDP will rise in France and Belgium over the next two years but decline significantly in Greece and Portugal, with modest declines also forecast in Italy and Spain.

根据国际货币基金组织的预测,未来两年,法国和比利时的债务与GDP的比例将上升,但希腊和葡萄牙的将大幅下降,意大利和西班牙的预计也将小幅下降。

Eurozone debt prices have fallen this week ahead of the European Central Bank’s rate-setting meeting on Thursday, where investors will watch for any hints as to when the central bank will start lowering rates. Markets are pricing in 1.3 percentage points of ECB cuts this year.

本周,在欧洲央行周四召开利率制定会议之前,欧元区债务价格已经下跌,投资者将关注央行何时开始降息的任何暗示。市场预计欧洲央行今年将降息1.3个百分点。

Still, despite the ECB’s deposit rate currently at a record high of 4 per cent, economic growth has been higher over the past year in Spain, Greece and Portugal than it has been in Germany or France, while Italy’s economy has stagnated.

不过,尽管欧洲央行的存款利率目前创下了4%的历史新高,但西班牙、希腊和葡萄牙过去一年的经济增速却高于德国或法国,而意大利的经济则停滞不前。

“Spain and Portugal have suffered less from the impact of the Russian war against Ukraine as the Iberian peninsula was less dependent on energy imports from Russia, while the Next Generation EU common debt issuance programme has benefited smaller countries the most,” said Oliver Eichmann, head of rates fixed income at Europe, the Middle East and Africa at DWS. Next Generation EU was set up in 2020 to reconstruct the region’s pandemic-stricken economies.

DWS欧洲、中东和非洲利率固定收益主管奥利弗•艾希曼(Oliver Eichmann)表示:“西班牙和葡萄牙受俄罗斯对乌克兰战争的影响较小,因为伊比利亚半岛对从俄罗斯进口能源的依赖程度较低,而下一代欧盟(Next Generation EU)共同债务发行计划使较小的国家受益最大。”“下一代欧盟”于2020年成立,旨在重建该地区受疫情影响的经济。

“There is a high likelihood that these established instruments will be used again in the future and that works in favour of less volatile spreads,” Eichman said.

“这些既定工具很有可能在未来再次使用,这对波动较小的利差有利,” 艾希曼表示。

The tightening of spreads comes in spite of the ECB’s announcement it would stop buying government debt earlier than planned and a gush of bond sales this month.

尽管欧洲央行宣布将提前停止购买国债,而且本月将大量出售债券,但利差仍在收窄。

Citi forecasts a record €165bn of eurozone government debt will be issued this month, 13 per cent higher than January last year. But demand has remained robust as markets bet the ECB will cut rates this year, with Spain attracting the largest ever order book for a sovereign bond on January 10 while Italy received €91bn in bids for a 30-year debt sale, the largest Italian order book since the start of 2021.

花旗银行预测,本月欧元区国债发行量将达到创纪录的1650亿欧元,比去年1月高出13%。但由于市场押注欧洲央行将在今年降息,需求依然强劲,西班牙在1月10日吸引了有史以来最大的主权债券订单,而意大利30年期国债销售收到了910亿欧元的投标,这是自2021年初以来意大利最大的订单。

Citi’s Bansal said that pressures from net issuance — after excluding bond redemptions and the ECB’s purchases — are greatest in the eurozone’s core countries, with France on track to issue a record €140bn net this year.

花旗银行的班萨尔表示,欧元区核心国家的净发行——剔除债券赎回和欧洲央行的购买后——压力最大,法国今年的净发行量将达到创纪录的1400亿欧元。

“France is slowly moving from a core to a periphery economy in terms of fiscal vulnerabilities,” said Tomasz Wieladek, chief European economist at T Rowe Price.

普信(T Rowe Price)首席欧洲经济学家托马斯•维尔德克(Tomasz Wieladek)表示:“就财政脆弱性而言,法国正缓慢地从核心经济体转向外围经济体。”

France’s annual budget deficit was 4.8 per cent of GDP in the third quarter of last year, up from 4.4 per cent the previous quarter, according to data from Eurostat this week, while Portugal, Greece and Ireland each clocked a surplus.

欧盟统计局(Eurostat)本周发布的数据显示,去年第三季度,法国的年度预算赤字占GDP的比例为4.8%,高于前一季度的4.4%,而葡萄牙、希腊和爱尔兰均实现了盈余。

Meanwhile, many investors believe that the ECB’s so-far untested transmission protection instrument, which allows the ECB to buy unlimited amounts of bonds of any member country judged to be suffering from an unjustified rise in its borrowing costs, offers protection against high interest rates for the bonds of “peripheral” countries.

与此同时,许多投资者认为,欧洲央行迄今未经检验的传导保护工具——允许欧洲央行无限额购买任何被认为借贷成本不合理上升的成员国的债券——为“外围”国家的债券提供了防范高利率的保护。

Mary-Therese Barton, chief investment officer for fixed income at Pictet Asset Management, said she expected a continued convergence of eurozone borrowing costs this year owing to the “collectivity of risk” across the bloc, alongside growing pressure for the eurozone’s largest countries to boost spending on defence and the energy transition.

百达资产管理公司(Pictet Asset Management)固定收益业务首席投资官玛丽-特蕾莎•巴顿(Mary-Therese Barton)表示,她预计今年欧元区借款成本将继续趋同,原因是整个欧元区的“风险集体化”,以及欧元区最大国家在国防和能源转型方面增加支出的压力越来越大。

“Despite all the doom mongers on the European project there is just this border narrative about socialisation of the debt more broadly . . . in which case spread convergence makes every sense,” Barton said.

巴顿说:“尽管有很多人对这一欧洲项目持悲观态度,但在更广泛的意义上,债务社会化只是一种边界叙事......在这种情况下,利差趋同是完全合理的。”

Additional reporting by Martin Arnold in Frankfurt

马丁•阿诺德(Martin Arnold)法兰克福补充报道